Indices CFD Trading on Exness

Exness offers comprehensive index CFD trading services, allowing traders to gain exposure to major global stock indices without purchasing individual stocks. Trade popular indices like the Dow Jones (DJIA), NASDAQ, FTSE 100, DAX 30, and Nikkei 225 with competitive spreads and flexible leverage options.

What are Indices Trading?

Trading indices is about speculating on stock group price changes. Indices track stock group performance, giving traders a market health view. Instead of buying single stocks, traders bet on overall index performance, simplifying sector exposure.

Key Characteristics of Indices

- Diversification: Trading indices can lower risk by spreading it across multiple securities, simpler than trading individual stocks.

- Benchmarking: Indices let you see how well a stock or the whole market is performing, helping traders evaluate their strategies.

- Liquidity: Major indices are easy to buy and sell quickly at known prices.

- Volatility: Indices typically move less than single stocks, but significant global events can still cause substantial price movements.

Major Indices Available for Trading on Exness

| Index Name | Symbol | Country/Region | Min Spread | Trading Hours (GMT) |

|---|---|---|---|---|

| Dow Jones | US30 | United States | 1.8 points | 01:00-23:15 Mon-Fri |

| NASDAQ | US100 | United States | 1.0 points | 01:00-23:15 Mon-Fri |

| S&P 500 | US500 | United States | 0.4 points | 01:00-23:15 Mon-Fri |

| FTSE 100 | UK100 | United Kingdom | 1.0 points | 09:00-17:30 Mon-Fri |

| DAX 30 | DE30 | Germany | 1.0 points | 08:00-22:00 Mon-Fri |

| Nikkei 225 | JP225 | Japan | 5.0 points | 00:00-21:15 Mon-Fri |

Unique Advantages of Index CFD Trading

Market Diversification Without Multiple Positions

Trading indices offers immediate diversification, as each index represents multiple companies across various sectors. Unlike trading individual stocks where you need multiple positions to diversify, a single index trade provides broad market exposure.

Lower Volatility Than Individual Stocks

Indices typically exhibit lower volatility than individual stocks, making them suitable for traders seeking more stable price movements. The diversified nature of indices helps moderate price swings that might affect single securities.

Extended Trading Hours

Many indices on Exness offer extended trading hours beyond the traditional stock market sessions, giving traders more opportunities to react to global economic events.

Economic Indicator Trading

Indices serve as effective barometers for economic health, allowing traders to position themselves based on macroeconomic forecasts rather than company-specific developments.

Why Trade Indices with Exness?

Trading market numbers with Exness has a lot of good things for both new and old traders:

- Global Market Access: Trade a wide range of global indices from the USA, Europe, Asia, and more.

- Competitive Pricing: Enjoy low spreads, helping you save on trading costs and increase profitability.

- Flexible Leverage: Leverage allows you to amplify your trades, potentially increasing profits (with corresponding risk).

- Advanced Trading Platforms: Use sophisticated platforms like MetaTrader 4 and MetaTrader 5, equipped with analytical tools, automated trading capabilities, and real-time data.

- Educational Resources: Access extensive educational materials and support to enhance your market knowledge and improve your trading strategies.

How to Get Started with Indices on Exness

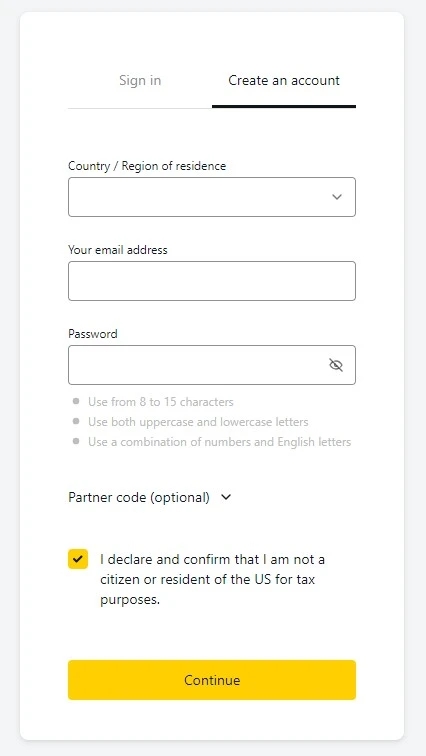

Using Exness to trade stock groups is simple. It’s made for all traders, whether they’re just starting or have experience. Here’s a guide to help you create an Exness account, explore the stock groups, and make your first trade on Exness.

Setting Up Your Exness Account

- Visit the official Exness website.

- Click on ‘Open Account’ or ‘Sign Up’ and provide your basic information.

- Complete the verification process by uploading identity and residence documents.

- Select your preferred account type based on your trading style and preferences.

- Fund your account using one of the available payment methods.

Navigating the Indices Market on Exness

- Access your preferred trading platform (MetaTrader 4 or MetaTrader 5).

- Explore the various indices available for trading.

- Utilize Exness tools to analyze the indices market, including charts, technical indicators, and news feeds.

Executing Your First Indices Trade

- Make a Plan: Study the market, make a plan for trade. Pick an index to trade, choose when to get in and out, set limits to manage risk, like stop-loss and take-profit.

- Do the Trade: Go to the trade part on your tool, pick the index, put in the trade details, like size and risk orders.

- Watch the Trade: When you do the trade, watch the market. See how the market moves the index price, and change your trade as you need with the tool.

Indices Market Conditions on Exness

Exness has good conditions for trading indices. This can really affect how traders do and plan. Knowing these conditions well is key for doing well in the indices markets.

Spreads

- Spreads show the gap between the selling and buying price of an index. It’s the fee for starting a position. Exness has narrow spreads, cutting trading costs and possibly raising profits, particularly for big traders.

Swaps

- Swaps are extra fees for keeping trades overnight. They show the cost or gain from holding a trade after the market closes. Swaps can be good or bad, based on the trade’s direction and current interest rates. Exness gives exact swap rates on the trading platform.

Dividends

- Dividends are profits given by companies in the index. If these companies pay dividends, it can change the index value and thus the index CFDs. Traders holding index CFDs on Exness may see changes in their accounts to show dividend payments, copying the effect of owning actual stocks.

Fixed Margin Requirements

- Fixed rules about the least money needed to start and keep a trading position. They help the broker guard against possible losses. Exness gives set rules for margin requirements for trading stock indexes. This makes it clear and expected how much money is needed for trading.

Stop Level

- The stop level on a trading platform is the shortest distance from the current price. Here, stop loss or take profit orders can be put. This stops orders from being too near and getting carried out due to usual market changes. Exness sets certain stop levels for different indices. These can be seen in the trading platform’s details for each thing.

Indices Trading Hours

- Trading times for market stuff on Exness depend on the kind of market stuff being traded. They are usually the same as the hours of the markets they come from. For example, the times for trading US market stuff are the same as the New York Stock Exchange, and for European market stuff, they’re the same as their own markets. Traders can find the exact trading times for each market item on the Exness platform. This helps them know when they can trade the market stuff they pick.

Popular Indices on Exness CFD Trading

Exness lets you trade on different world market numbers. You can bet on how well the main parts of big countries are doing. These are a few top numbers you can trade with Exness.

Dow Jones Industrial Average (DJIA)

The Dow is made of 30 important stocks from NYSE and NASDAQ. It shows how well the United States factories are doing. It’s very old and lots of people look at it. The Dow changes when important money and business things happen, like how much factories make and big political things.

NASDAQ Composite

This list has over 3,000 stocks from US and foreign tech and internet-related firms on NASDAQ. It mainly focuses on tech companies. The NASDAQ Composite is very responsive to news about tech progress, rule changes in tech, and changes in consumer tech behavior.

FTSE 100

The “Footsie” is made of the top 100 companies on the London Stock Exchange (LSE). It shows how the UK stock market and economy are doing. The FTSE 100 goes up and down based on economic predictions, Brexit news, and global trade that affects the UK market.

DAX 30

The DAX 30 has 30 big German companies on the Frankfurt Stock Exchange. People use it to see how well the German economy and the bigger European market are doing. Germany’s economic data like GDP growth, jobs, and manufacturing info can change how the DAX 30 moves.

Nikkei 225

This list shows 225 best companies on the Tokyo Stock Exchange and is a signal of how well the Japanese stock market is doing. The Nikkei 225 reacts a lot to exchange rate shifts, especially the JPY/USD pair, and Japan’s bank rules.

Strategies for Trading Indices

- Diversification: Trade a mix of indices to spread risk. Not all markets react the same way to major events, helping balance gains and losses.

- Trend Following: A successful approach is to identify and follow market trends. Tools like moving averages can help determine if an index is in an uptrend or downtrend and decide when to enter or exit.

- News Trading: Index trading is influenced by news events. Monitor major economic announcements, corporate reports, or significant political shifts to identify potential trading opportunities.

- Technical Analysis: Use indicators like RSI, MACD, or Fibonacci retracements to help determine entry and exit points.

- Hedging: Use index CFDs to hedge against losses in other positions. If you hold stocks in an index and anticipate a market downturn, you can short the index to mitigate losses.

Start Trading Indices with Exness Today