Understanding Exness Overnight Charges

One of the largest forex broker – Exness applies its own overnight charges for positoins longer than trading hours. These fees (also known as “swap rates”) can significantly impact trading profitability, especially for long-term positions. All of this is important to understand for trading strategy optimization and effective risk management.

What Are Overnight Charges?

Overnight charges are fees applied to trading positions held open past the end of each trading day (typically 5 PM EST). These charges reflect the interest rate differential between the two currencies in a forex pair. For instance, when trading EUR/USD, the charge is based on the interest rate gap between the Euro and US Dollar.

Types of Exness Overnight Charges

Exness online broker applies two main types of overnight charges:

Swap rates

Swap rates are interest-based fees that can be either positive (credited to the trader’s account) or negative (debited from the account). These rates are determined by the interest rate differential between the two currencies in a forex pair. For example, if a trader holds a long position in USD/JPY, they may receive interest on the USD (if its interest rate is higher) while paying interest on the borrowed JPY.

Administration fees

In addition to swap rates, Exness may charge administrative fees for positions held overnight. These fees cover the operational costs associated with maintaining open positions outside regular trading hours. Unlike swap rates, administration fees are typically fixed and do not fluctuate based on interest rate differentials.

It’s worth noting that Exness applies a triple swap on Wednesdays (or Fridays for some instruments) to account for the weekend when markets are closed. This practice ensures that traders are charged appropriately for holding positions over non-trading days.

For traders looking to avoid overnight charges, Exness offers swap-free (Islamic) accounts. However, these accounts may have specific eligibility criteria and alternative fee structures.

How to Calculate Overnight Charges

Calculating Exness overnight charges involves several factors:

- Swap rate: Found in the contract specifications for each instrument.

- Position size: Larger positions incur higher charges.

- Number of nights: Charges accumulate for each night held.

The basic formula is:

Overnight Charge = (Swap Rate * Position Size * Number of Nights) / 10

For example, a 1 lot EUR/USD position with a -0.85 swap rate held for 3 nights would result in: (-0.85 * 100,000 * 3) / 10 = -$25.50

On Wednesdays (for most instruments), the swap is tripled. For instance, holding a position from Tuesday to Thursday incurs 3x the normal rate. You can simplify these calculations using the Exness Calculator, which helps traders quickly estimate their overnight fees and other trade metrics.

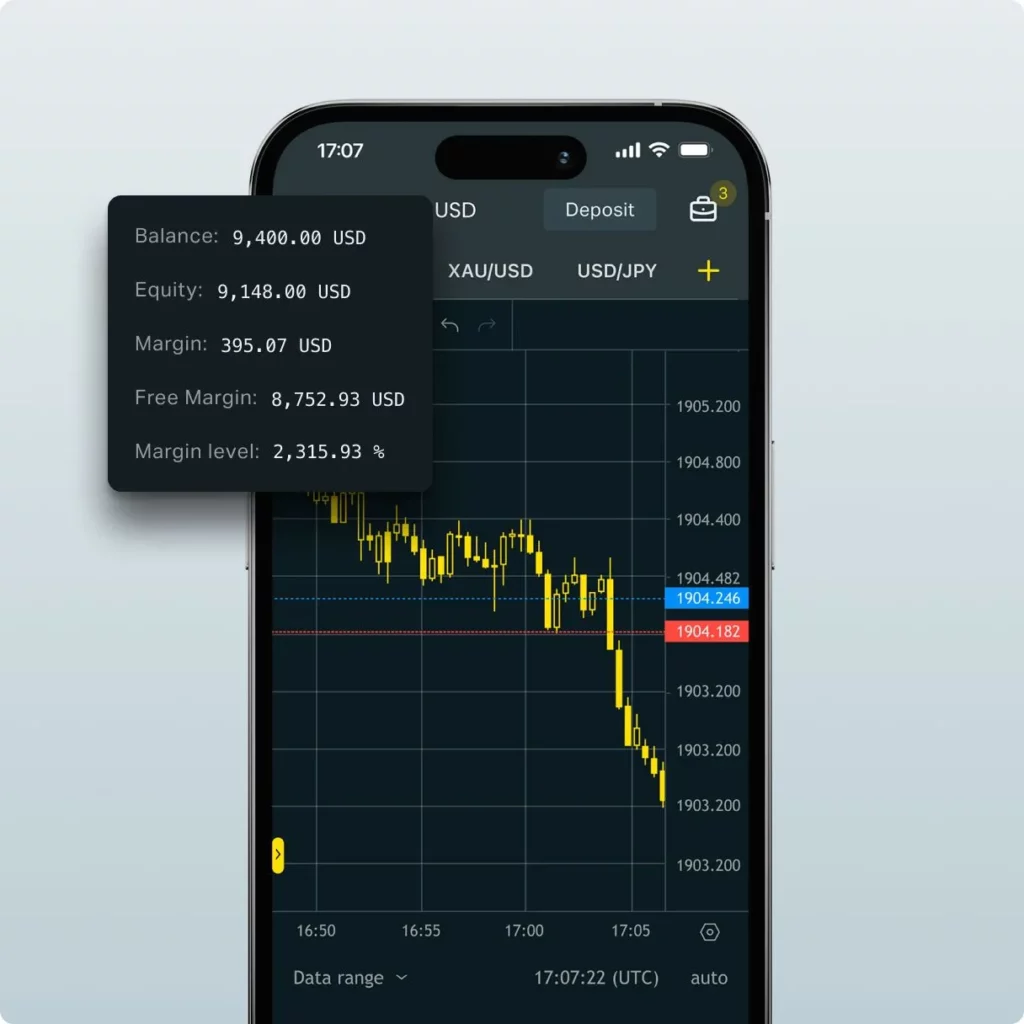

Viewing Overnight Fees on MT4/MT5

Exness provides easy access to overnight fee information on MetaTrader platforms:

- Open MT4/MT5 and log into an Exness account.

- Right-click on the desired symbol in the “Market Watch” window.

- Select “Specification” from the dropdown menu.

- Scroll down to find “Swap Long” and “Swap Short” values.

These values represent the overnight fees for long and short positions, respectively. Positive numbers indicate a credit, while negative numbers represent a charge.

Best Practices for Managing Overnight Fees

Effective management of overnight fees can significantly impact trading profitability:

- Timing trades: Consider opening positions after 21:00 GMT to avoid immediate charges.

- Utilize swap-free accounts: You can use Exness Islamic accounts (without swaps) for eligible traders.

- Monitor holding periods: Long-term positions accumulate higher fees – factor this into strategy.

- Leverage calendar awareness: Remember triple-swap days (usually Wednesdays) for most instruments.

- Regular fee checks: Stay updated on current swap rates, as they can change based on market conditions.

- Incorporate fees in profit calculations: Don’t forget to factor in overnight charges when assessing potential trade profitability.

- Consider trading direction: Long vs. short positions may have different swap rates – choose wisely.

By implementing these practices, traders can minimize the impact of overnight fees and potentially enhance their overall trading performance on the Exness platform.

Explore our latest posts to level up your trading experience.

- Crypto CFD TradingWhat is Crypto Trading? Trading crypto means buying and selling digital money to make money from price changes. It’s different from normal investing. You can trade one crypto for another or trade crypto for real… Read More »Crypto CFD Trading

- Indices CFD TradingWhat are Indices Trading? Trading indices is about speculating on stock group price changes. Indices track stock group performance, giving traders a market health view. Instead of buying single stocks, traders bet on overall index… Read More »Indices CFD Trading

- Forex CFD TradingWhat is Forex and How Does it Work? Forex trading involves buying one currency while simultaneously selling another to speculate on price movements. Exness Forex CFDs allow traders to participate without the need for actual… Read More »Forex CFD Trading

Feel free to peruse all our posts about online trading for a comprehensive experience.